Tulsa Bankruptcy Filing Assistance - The Facts

The Greatest Guide To Affordable Bankruptcy Lawyer Tulsa

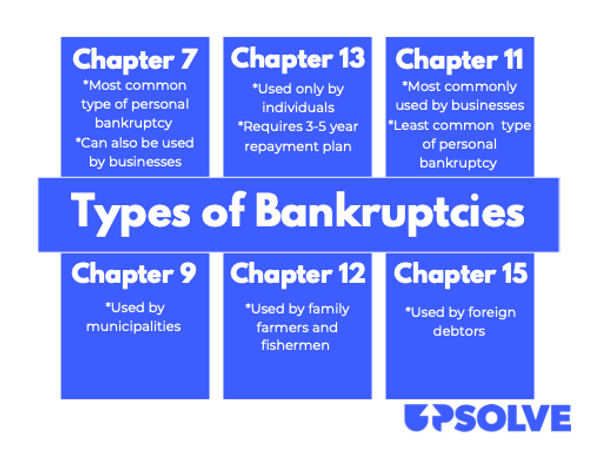

People should use Chapter 11 when their debts surpass Chapter 13 financial debt limitations. Phase 12 insolvency is created for farmers and fishermen. Chapter 12 repayment plans can be more adaptable in Chapter 13.

The means examination looks at your average regular monthly income for the 6 months preceding your filing day and compares it against the mean revenue for a similar house in your state. If your earnings is below the state typical, you automatically pass and do not need to finish the entire type.

If you are married, you can file for bankruptcy jointly with your partner or independently.

Filing insolvency can aid a person by throwing out debt or making a strategy to repay debts. An insolvency case normally begins when the borrower submits an application with the personal bankruptcy court. There are various types of insolvencies, which are generally referred to by their phase in the U.S. Bankruptcy Code.

Filing insolvency can aid a person by throwing out debt or making a strategy to repay debts. An insolvency case normally begins when the borrower submits an application with the personal bankruptcy court. There are various types of insolvencies, which are generally referred to by their phase in the U.S. Bankruptcy Code.If you are dealing with monetary challenges in your personal life or in your service, opportunities are the idea of filing bankruptcy has crossed your mind. If it has, it likewise makes sense that you have a great deal of insolvency inquiries that require responses. Many individuals actually can not answer the concern "what is personal bankruptcy" in anything except general terms.

Many individuals do not understand that there are a number of sorts of personal bankruptcy, such as Chapter 7, Chapter 11 and Chapter 13. Each has its benefits and difficulties, so knowing which is the most effective alternative for your present scenario in addition to your future healing can make all the difference in your life.

Phase 7 is called the liquidation personal bankruptcy phase. In a chapter 7 personal bankruptcy you can get rid of, clean out or discharge most kinds of financial obligation.

Affordable Bankruptcy Lawyer Tulsa Can Be Fun For Everyone

Many Chapter 7 filers do not have a lot in the way of properties. Others have houses that do not have much equity or are in significant need of fixing.

Financial institutions are not enabled to go after or preserve any collection activities or suits during the case. A Chapter 13 personal bankruptcy is really effective since it supplies a mechanism for debtors to avoid foreclosures and constable sales and stop repossessions and utility shutoffs while capturing up on their protected financial obligation.

A Chapter 13 situation might be helpful in that the debtor is permitted to obtain caught up on mortgages or auto loan without the danger of repossession or repossession and is permitted to maintain both excluded and nonexempt residential property. bankruptcy lawyer Tulsa. The borrower's plan is a document laying out to the personal bankruptcy court exactly how the debtor recommends to pay current expenses while paying off all the old financial debt equilibriums

It gives the debtor the chance to either sell the home or end up being captured up on home loan payments that have actually fallen back. An individual submitting a Chapter 13 can propose a 60-month plan to cure or end up being current on home mortgage repayments. If you dropped behind on $60,000 worth of home mortgage repayments, you might propose a plan of $1,000 a you could look here month for 60 months to bring those mortgage repayments present.

It gives the debtor the chance to either sell the home or end up being captured up on home loan payments that have actually fallen back. An individual submitting a Chapter 13 can propose a 60-month plan to cure or end up being current on home mortgage repayments. If you dropped behind on $60,000 worth of home mortgage repayments, you might propose a plan of $1,000 a you could look here month for 60 months to bring those mortgage repayments present.3 Simple Techniques For Affordable Bankruptcy Lawyer Tulsa

Occasionally it is better to prevent insolvency and resolve with lenders out of court. New Jacket likewise has an alternative to personal bankruptcy for companies called an Task for the Advantage of Creditors (Tulsa OK bankruptcy attorney) and our law practice will look at this choice if it fits as a possible approach for your organization

We have developed a tool that helps you pick what phase your file is probably to be filed under. Click on this link to use ScuraSmart and discover out a possible service for your financial debt. Lots of people do not realize that there are several kinds of personal bankruptcy, such as Chapter 7, Chapter 11 and Chapter 13.

6 Simple Techniques For Which Type Of Bankruptcy Should You File

Right here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we deal with all types of bankruptcy cases, so we have the ability to answer your insolvency questions and aid you make the very best decision for your instance. Below is a short check out the financial debt alleviation alternatives readily available:.

You can just submit for personal bankruptcy Prior to declare Phase 7, a minimum of one of these should be real: You have a great deal of debt revenue and/or assets a financial institution might take. You lost your driver permit after being in a mishap while without insurance. You need your permit back. You have a lot of financial obligation near to the homestead exception amount of in your house.

Hanson & Hanson Law Firm, PLLC

Address: 4527 E 91st St, Tulsa, OK 74137, United StatesPhone: +19184090634

Click here to learn more